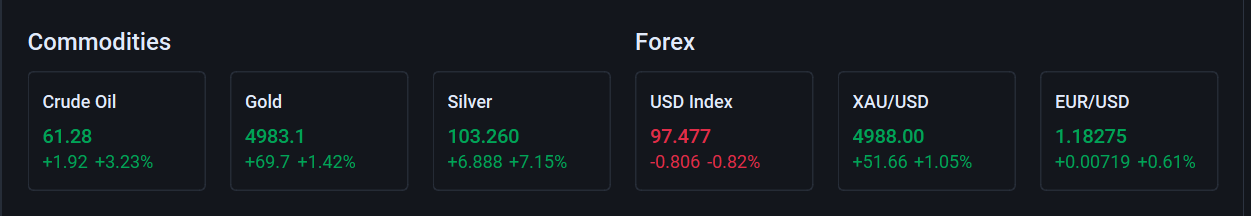

Commodities

Crude Oil +3.23% → strong momentum, inflation pressure remains.

Gold +1.42% & Silver +7.15%

🔎 Interpretation: Classic risk-off + hedge flows. Silver is extremely strong → speculative flight to safety combined with an inflation hedge.

$ GBP (Bailey) and USD (FOMC

Biggest move potential is in GBP (Bailey) and USD (FOMC). Be cautious 8:15–10:00 ET. Wait 2–5 min after the spike, trade break & retest (M5/M15) with tight risk. Pairs like $GBPUSD, $EURGBP, $GBPJPY.

$ROLR

This is classic momentum/news-driven pump on low float/micro cap behaviorexciting but risky. Watch for after hours/ pre market continuation or fade tomorrow. Not investment advice; always verify real time data.

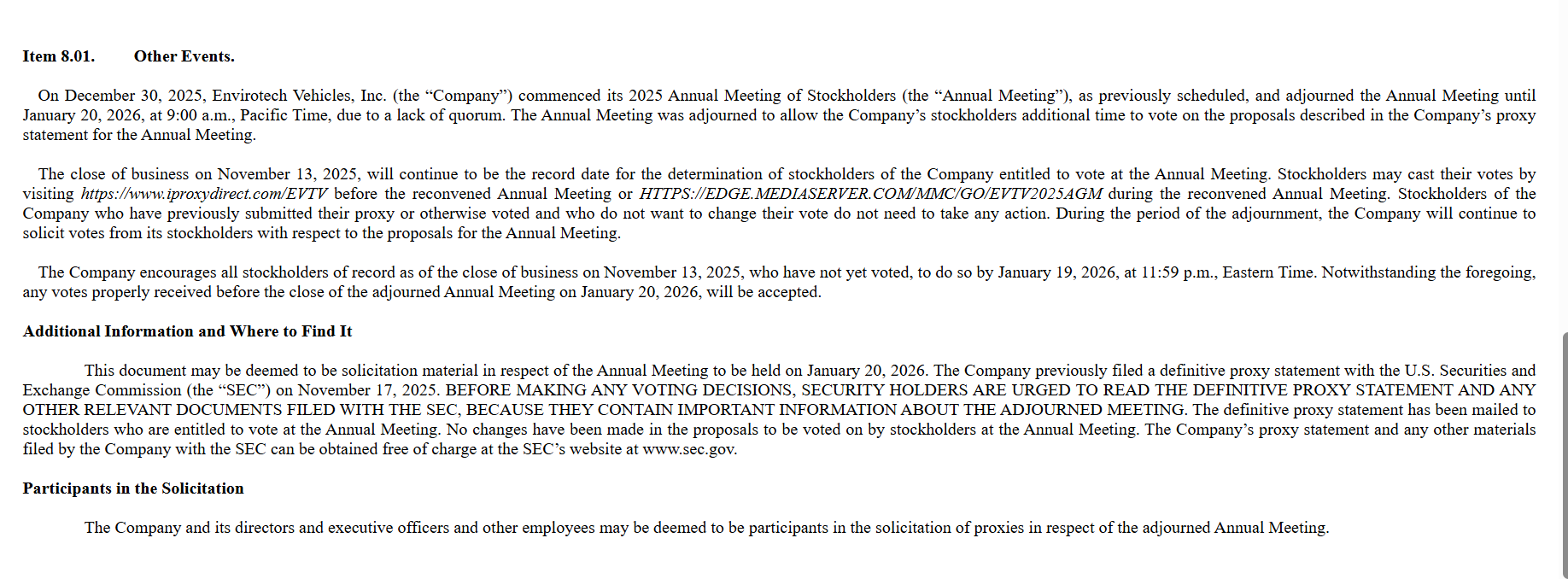

$EVTV

This is an official notice from Envirotech Vehicles (NASDAQ: EVTV) saying their 2025 annual shareholder meeting started on December 30, 2025, but was immediately paused (adjourned) because not enough shareholders showed up or voted to reach a quorum (the minimum participation needed to officially hold the meeting and vote on things).They rescheduled it for January 20, 2026, at 9:00 a.m. Pacific Time.Key points in plain English:

The record date (who can vote) stays November 13, 2025 no change.

If you already voted by proxy, you don't need to do anything unless you want to change your vote.

The company is still asking people to vote during this delay (they need more votes to hit quorum).

Please vote by January 19, 2026, 11:59 p.m. Eastern if you haven't yet (but votes are accepted right up to the end of the meeting on Jan 20).

$ANPA

Classic momentum + EMA support + consolidation breakout setup.

$PLRZ

Biotech microcap (Polyrizon Ltd.) developing intranasal hydrogels (allergy/viral blockers). Recent catalysts include manufacturing milestone (Dec 2025), FDA interactions, and Jan 2, 2026 PR on flu season relevance for PL-16 product fueling multi week surge.Bullish if holds above 10.00; potential for retest of highs on news. Extreme volatility high risk/reward in low float penny stock.

Today's PR (Jan 2, 2026) highlights PL16 Viral Blocker as extra shield amid intensifying U.S. flu surge timely catalyst driving momentum in this low float biotech penny stock.

$BNAI

Momentum driven by recent AI pharma deal news (Dec 2025), fueling multi day surge in this volatile small cap AI stock (Brand Engagement Network).

Bullish short term if holds above $3.3; watch for pullback on profit taking. High risk due to volatility.

Today, December 23, 2025, several stock splits take effect: Texas Pacific Land (TPL) is executing a 3-for-1 forward split, while TNL Mediagene (TNMG) is conducting a 1-for-20 reverse split, Boxlight Corp (BOXL) a 1-for-6, and Cheer Holding (CHR) a significant 1-for-50 – all with the ex-date today.

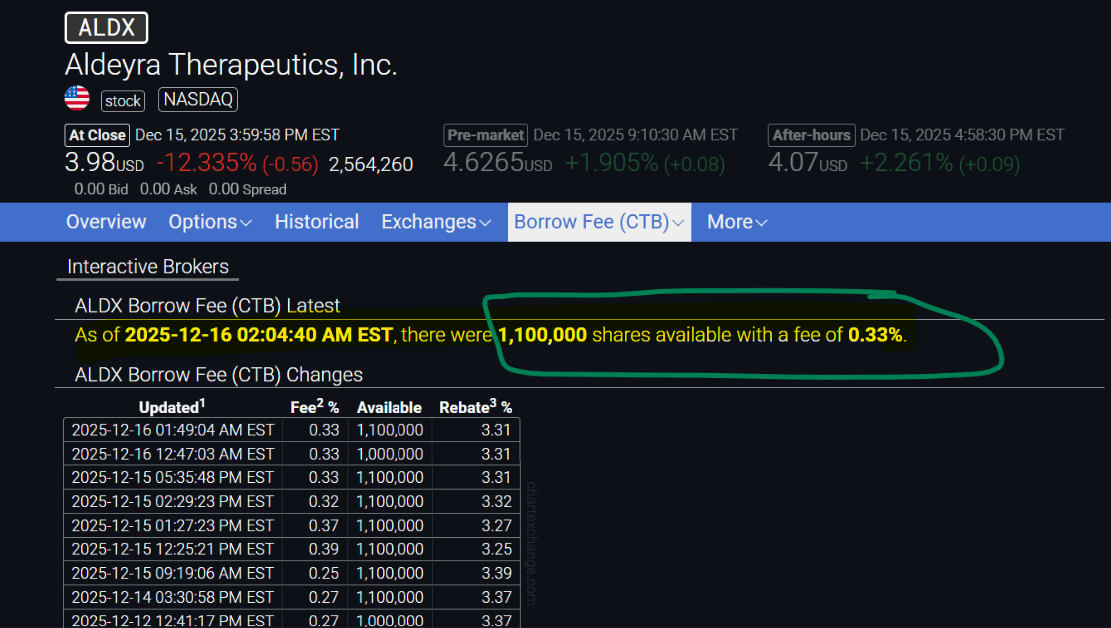

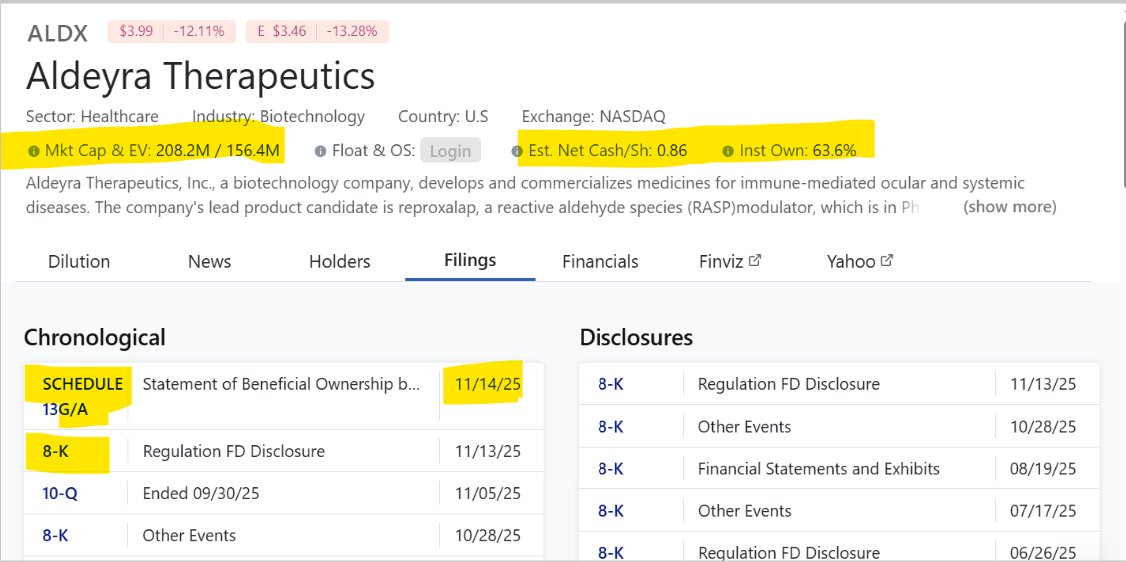

$ALDX

Analys

According to... Low dilution risk right now. Is not a major concern at this stage.Borrow fee (CTB) is 0.33% → extremely low.Current move is not driven by shorts, but by price action/news/liquidity.Cash backed biotech Institutions still heavily involved.

$CHR

Analys

CHR Hansen is moving within a clear range, with the price recently breaking down from the upper liquidity zone and now testing support around $549–$548; if this area fails to hold, the next major liquidity and support level around $544 becomes the magnet, while a quick reclaim of $553 would shift the structure back to bullish.

$TGL

Analys..

This is a decision point.

Price is compressing into support inside a descending triangle a break of $47 means bearish continuation, a rebound from $47–50 gives a quick long back to $55.

$PLRZ

Analys

Still bearish. No reversal signal yet. Risk of drop to $9–$10 zone if 12₤ support breaks. Only a strong close above $15 + EMA50 would invalidate the downtrend. Until then, downside favored.

$PLRZ

Analys

Neutral → slightly bearish on the 1 minute timeframe.

As long as the price doesn’t break above 17.60 with strong volume, there is a risk of a retest of $17 → $16 → $15.17.

A larger reversal is more likely either at the grey demand zone ($13.60–$14.00) or if the price reclaims $17.60 with strength.

$PHVS

Precigen is a highly speculative, binary bet on its proprietary technology platforms. Its success hinges entirely on positive clinical data and its ability to fund operations without excessive dilution.

While the technology is intriguing, the company faces significant financial and clinical execution risks. The current market sentiment reflects these substantial challenges. Extensive due diligence is required before considering an investment.

$FOXX

Analys

Caught $FOXX at the Fair Value Gap $2.90

Sold the rip at $6.01 → +105% in 11 days Clean setup, zero heat, full exit on the breakout spike.

Another quick double digit winner.

$EB

News

Eventbrite is a niche player in event tech showing recovery growth, but operates in a competitive, cyclical market while navigating a path to consistent profitability.

$JSPR

News

The key recent development is that Jasper Therapeutics has entered into a definitive agreement to be acquired by Autotech Partners for $4.35 per share in an all cash transaction. This represents a significant premium to the stock's recent trading price.

The transaction is expected to close in the second half of 2024, subject to shareholder approval and customary closing conditions.

$MDB

News

MongoDB is a high growth, cloud focused database software company disrupting the traditional database market.

$CEP

News

Constellation Energy Partners LLC (CEP) is an upstream oil and gas company focused on acquiring and developing natural gas and oil properties. It operates in the mid continent region of the U.S. The company's stock is listed but no longer actively trading.

$SMX

News

SMX PLC's stock jumped 48.28% in after-hours, reaching $25.80, after the company showcased its molecular identity technology at the DMCC Precious Metals Conference in Dubai.

Their tech embeds invisible molecular markers into materials, offering permanent, tamper-proof authentication without paper labels.

SMX demonstrated the solution to major industry players, including refiners, vault operators, and bullion bankers, boosting market confidence.

$SMX

Analys

Right now price is resting on the EMA50 and the chart shows weakening momentum → a bearish pullback toward $17.22 is slightly more probable unless new volume enters.

$KALA

Analys

Based on the wedge breakout → retest → ascending-trend continuation, bulls are currently in control.Bullish momentum continues above 0.8051, with a clean path toward 0.90–0.92 next.

$MIGI

The chart is showing clean bullish structure. As long as price stays above EMA50 + trendline, the move toward $7.60 → $8.00 remains highly likely.

You can scalp long on:

Pullback to $6.50–$6.70

Breakout above $7.05

Stop loss under $6.13 for momentum trades.

$ICON

Price formed a bullish triangle and has now broken out upward, showing strength.

As long as it holds above $1.23 support, momentum stays bullish.

EMA50 at $1.147 is rising, confirming trend support.

Next upside target is $1.33 (previous high).

If it falls back under $1.23, expect weakness toward $1.15–$1.05.

$INHD

This chart uses a trend breakout strategy combined with demand and supply zones.

The uptrend begins when price breaks above the first consolidation and stays above the EMA50, confirming strong bullish momentum.

A clean pullback into the demand zone around 1.00 gives the ideal buy entry.

From there, price continues upward until it reaches the next supply zone at 2.30, which becomes the first place to take profit.

The final sell exit occurs at the major supply level around 3.45–3.47, where the trend shows exhaustion and reverses sharply downward.

When price later breaks below the EMA50 and below the demand zone, the bullish trend ends and no further buys should be taken.

$PMNT

News

Perfect Moment is reporting a period of high quality, profitable growth. The market's reaction will be positive because the company is demonstrating it can scale effectively while improving its bottom line, all while securing high profile partnerships that enhance its brand value.

$MLSS

News

The news of MLSS reporting $2.4M in revenue (and potentially beating estimates) is a positive fundamental catalyst that could lead to a rise in its stock price as it demonstrates strong commercial performance.

$IDN

Analys

The chart for INTELLICHECK INC (IDN) depicts a stock in a pronounced and sustained long-term downtrend. After a significant peak, the price has collapsed, falling from a high near $10.20 to a low of $3.70, a decline of over 60%. The extremely low volume of 370 shares indicates a complete lack of buyer interest and high illiquidity, making the stock vulnerable to sharp moves.

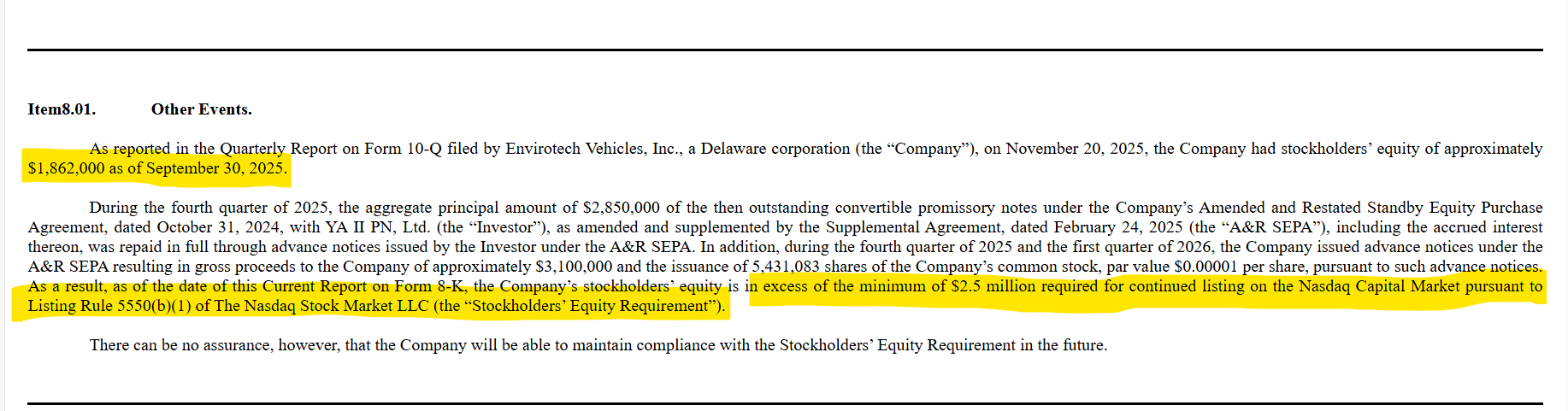

Strength: The balance sheet has been shored up (equity requirement met).

Weakness: Market valuation remains poor, indicating a lack of confidence that must be resolved by January 2026 to avoid delisting.

The company has fixed a fundamental accounting metric but still needs to convince the market of its value.

$DRCT

News

DRCT has regained compliance with Nasdaq's minimum equity requirement and has been given until January 30, 2026, to meet the minimum $1.00 share price requirement.

The company has addressed a key balance sheet issue, but its market valuation (stock price) remains a critical challenge to its overall economic health.

The data for DIRECT DIGITAL HOLDINGS (DDHL) shows a stock under significant selling pressure, having experienced a sharp and sustained decline throughout the trading session. The price has fallen from levels around $0.35 to a low of $0.10, representing a potential drop of over 70%. The high volume confirms this was a decisive move with strong conviction from sellers.

$MRSN

Strong after huge gap up holding gains = healthy structure.

Still needs fresh volume to confirm next breakout; momentum intact while above $27.

Verdict: Bullish bias, consolidation phase; watch $29.88 breakout or $27 support hold.

Net Flow: This is the single most important summary metric. It's calculated as Inflow Outflow.

Inflow: 3.51 Million USD

Outflow: 6.01 Million USD

Net Flow = 3.51 - 6.01 = -2.50 Million USD

This negative value shows a net selling pressure over the period.

The Breakdown of Inflow (Who is Buying):

Medium orders (20.48% / 1.95M) and Large orders (13.74% / 1.31M) are responsible for almost all of the buying (inflow). This suggests that while there is significant selling, larger players are still showing some interest in buying.

The Large Scale Orders Chart (Historical Context):

This shows a significant spike in large-scale orders (27.70% / 2.64M) on a recent day (likely 11/10). This is a crucial piece of context, indicating a major event or shift in sentiment happened very recently.

$NVVE Analys

Short term bullish momentum from strong Japan deal news, but fundamentals remain weak and risky high volatility, good for momentum trades only with tight risk control.

NVVE shows short term bullish bias as long as price holds above $0.52.

Key breakout trigger = $0.59;

Key support = $0.52 / $0.44.

Momentum confirmation requires increasing volume near resistance.

$MSGM

Positive news

Motorsport Games (MSGM) shares rallied after Q3 2025 results showed EPS of $0.14 (up from –$0.18) and revenue up 71.9% to $3.1M, boosted by strong sales of Le Mans Ultimate, which earned Mostly Positive reviews on Steam.

$MSGM shows strong long term momentum and quality improvement post earnings. Massive volume and price surge signal renewed investor confidence.

$NFE

NFE is a high-risk/high reward trade. The restructuring path via UK offers a potential reset scenario, but the company’s financial health is weak and the upside only material if several favourable things happen. In other words: the potential is there, but so is substantial downside. For someone like you who trades actively, this could be a play rather than a safe bet.

Slight sell pressure dominates (1.4M vs 0.95M buys), but high neutral volume shows indecision market stable near $1.20 with potential breakout or breakdown ahead.

$DFSC

Stock Analys

Overall Summary

The chart is showing a strong and multi-timeframe bullish case. The signals progress from early momentum shifts on weekly charts to a significant trend reversal confirmation on the daily chart. This suggests a building and then confirmed upward move.

Signal Breakdown (From Oldest to Newest)

1. August 22, 2025 (Weekly Chart) - Triple Moving Average Crossover

What it means: This is a classic trend-following signal. It occurs when a shorter-term moving average (e.g., the 4-week) crosses above a medium-term one (e.g., the 9-week), which in turn is above a long-term one (e.g., the 18-week). This alignment indicates that momentum is shifting positively across short, medium, and long-term timeframes.

Interpretation: This was an early warning of a potential change in trend from bearish to bullish on the higher-timeframe weekly chart.

2. August 29, 2025 (Weekly Chart) - Inside Bar (Bullish)

What it means: An "Inside Bar" is a candlestick pattern where the entire price action (high-to-low) of one bar is contained within the range of the previous bar. It signifies market consolidation and indecision. A bullish interpretation is given when this pattern occurs during an uptrend or at a potential support level, and is followed by an upward breakout.

Interpretation: Following the moving average crossover, this pattern showed a brief pause or consolidation. The "bullish" label indicates the subsequent price action broke upward, reinforcing the positive momentum suggested by the previous signal.

3. September 19, 2025 (Weekly Chart) - Medium-term KST

What it means: The KST (Know Sure Thing) is a momentum oscillator that aggregates multiple timeframes of rate-of-change data. A bullish KST signal typically occurs when the indicator crosses above its signal line or moves from negative to positive territory. The "Medium-term" label focuses on the intermediate trend.

Interpretation: This signal confirmed that bullish momentum was not just a short-lived bounce but was strengthening in the medium-term trend. It added a momentum-based confirmation to the earlier trend-following signals.

4. October 1, 2025 (Daily Chart) - Price Crosses Moving Average (50-Day)

What it means: This is a significant milestone where the current price moves above the 50-day simple moving average. The 50-day MA is widely watched as a dynamic support/resistance level and a barometer for the intermediate-term trend.

Interpretation: This signal brought the bullish evidence from the weekly chart down to the more sensitive daily chart. It indicated that the buying pressure was strong enough to push the price above a key average that many traders use to define a bullish vs. bearish market, likely attracting more buyers.

5. October 7, 2025 (Daily Chart) - Head and Shoulders Bottom

What it means: This is one of the most powerful and reliable major trend reversal patterns. It is formed by three troughs: a middle trough (the head) that is the lowest, flanked by two shallower troughs (the shoulders). The pattern is confirmed when the price breaks upward through the "neckline" resistance level.

Interpretation: This is the strongest signal on the list. A Head and Shoulders Bottom pattern ending with an upside breakout signifies that a prolonged downtrend has likely ended and a new major uptrend has begun. Its appearance on the daily chart, following the other bullish signals, is a very strong confirmation of the new bullish trend.

Conclusion and Implication

The sequence of signals paints a clear picture:

The weekly chart first showed signs of life with a trend change (Moving Average Crossover) and momentum build-up (KST).

This strength filtered down to the daily chart, with the price reclaiming a key level (50-day MA).

The move was ultimately confirmed by a major reversal pattern (Head and Shoulders Bottom).

This multi-layered, multi-timeframe analysis suggests a high-probability bullish outlook. The trend, according to these technical indicators, has shifted from bearish to bullish.

$BENF

Analys

The short term momentum is strongly bullish. Watch the battle between the new support at $0.973 and the resistance at $0.9998. The outcome of this test will dictate the next major move. The high volume suggests the current move has conviction.

$INSP

My Analys

Await a confirmed breakout with volume from the $78.11 - $79.50 zone to determine if it will rebound toward $80 or fall to $76.73.

The stock is in a state of indecision and low liquidity. The flat line is misleading and does not indicate stability. Bullish Scenario: A move above $79.50 with increasing volume could signal a rebound towards $80+. Bearish Scenario: A break below $78.11 could lead to a retest of support near $76.73. Wait for a confirmed breakout with volume from the current consolidation zone ($78.11 - $79.50) to determine the next directional move.

$ARCT

My Analys

The $11.00–$11.20 range is a make or break zone.

A breakout above $12.92 could ignite a rally toward $15.80–$19.50,

while a breakdown below $11.00 risks a slide to $10.28 or lower.

Watch for volume confirmation and candle structure before positioning.

Fibonacci structure aligns perfectly with key price zones a breakout above $12.92 confirms bullish reversal toward $14.40–$17.60, while a close below $11.00 signals continuation to $9.00 support.

$SCNX

Analys

$SCNX is showing signs of a potential long term reversal with explosive volume.

Holding above EMA20 keeps the bullish bias intact any drop below 1.00 would weaken momentum and risk retesting 0.60.

$SLMT

Positive News

Brera Holdings (SLMT) has secured a 60 day extension for filing its initial resale registration statement with the SEC. The Solana based crypto infrastructure company stated this provides more flexibility to meet regulatory requirements. The stock currently has a Strong Buy technical sentiment.

$IBIO

IBIO showed positive momentum with a solid gain on decent volume. Its position above important short-term moving averages supports a bullish near to medium term outlook. However, it remains far below its long term average, suggesting a sustained recovery would be needed to reverse the larger downtrend.

$HTCR

Analys

The stock experienced a high volume sell off, pushing the price down and below key moving averages. While the mediumterm outlook is still slightly tilted bullish, the current price action and position relative to the MAs suggest near term weakness and a test of the recent lower trading range.

$XRTX

Based on the strong bullish candle and high volume shown on this 5-minute chart, the most logical price targets are $1.26 (immediate) and $1.40 - $1.53 (primary).

The move is significant and well-supported by volume, suggesting a high probability of testing at least the first resistance level. The neutral RSI provides ample runway for further gains.

$RANI

Expect a potential short term pullback or period of consolidation to cool the overbought conditions. The overall trend remains bullish as long as the price holds above key support levels like the MA9 ($1.038).

Analys price target

Based on the technical picture from the chart provided, the most immediate and realistic price target is $1.20 to $1.32.

For this target to be achieved, the stock must maintain its current momentum and successfully challenge the resistance level it is approaching.

$KZR

Economic health is fragile, with growth hinging on clinical success. Monitor trial results and volume trends for directional cues.

Price target

The after hours surge to $6.07, backed by volume and analyst optimism ($12.50 target), suggests a short-term target of $6.50–$7.00. Long-term potential aligns with $12.50 if clinical trials (e.g., zetomipzomib updates) succeed. Monitor support at $4.10 and resistance at $6.59.

$ARTV

Positive News

Penny stock

Artiva Biotherapeutics (AlloNK (AB 101) UpdateFDA Fast Track Designation: Granted for AlloNK (AB-101) to treat refractory rheumatoid arthritis (RA), addressing an unmet need for over 100,000 treatment-resistant patients. Therapy Details:

Enhances B-cell-targeting antibodies (e.g., rituximab) for deeper, more durable B-cell depletion.

Treated over 20 patients across multiple autoimmune diseases.

Timeline:

Initial safety and translational data: Mid-November 2025.

Clinical response data for refractory RA: First half of 2026.

Potential FDA interactions to advance to pivotal trial.

Significance: Marks progress toward addressing a critical medical gap.

$ARTV

My Analys

Price holds near support with neutral RSI, suggesting indecision. Volume spike hints at potential move; watch $2.810 for breakout or $2.470 for further decline.

$GITS

GITS Stock Overview (as of Oct 16, 2025)Company: Global Interactive Technologies, Inc. (formerly Hanryu Holdings, Inc.)

A technology driven platform company in South Korea, operating Faning (interactive fandom platform for content discovery, monetization, and engagement) and Koreavibe.net (digital media for K-culture news and features). Founded 2018, based in Seoul.

Weekly Report

Last week, GITS stock experienced a 10.57% loss, with the price dropping from 2.27 to 2.03. The week's high was 2.33, the low was 2.03, and the cumulative volume was 146.47K.

Today’s volume spike suggests strong buying interest, possibly FOMO-driven. RSI indicates room for growth before overbought. Watch $2.52 for breakout or $2.087 for reversal. High volatility expected.

$NXST

Positive News

Nexstar Media Group and Xsolla launched a gaming vodcast series to reach millions, diversifying NXST's content and targeting the growing gaming audience. This could boost digital revenue and attract younger demographics, potentially increasing stock interest, though success hinges on audience engagement and ad revenue.

Date: 2025-10-16

$NXST

Price target $219

The short term trend is bullish. A hold above the $198.5 support suggests a potential test of the $205 resistance level. A break below the moving average support would signal a potential pause or reversal of the current uptrend.

$TOVX

Positive News

Penny Stock

TOVX exhibits a short term bullish outlook if it sustains above the $0.6553 resistance level, with a critical need for a volume spike to confirm the trend. Strong buy interest, with 2.05M shares outpacing sells at 0.91M, indicates bullish pressure despite significant neutral volume (88.73M); sustained buying momentum is essential for validation. It consensus sets a uniform price target of $6.00 (high, average, low) based on two analysts, reflecting robust confidence, with the current price of $0.64 suggesting a potential upside of approximately 1,000% if targets are achieved.

Date: 2025-10-15

$FOSL

Positive News

Penny Stock

Fossil Group (FOSL) surges 28% to $3.40 amid high volume (1.6M shares), testing 52-wk high of $3.58. Maxim Group initiates Buy rating (Jul 2025).Price Target: $5.00 (upside ~47%).

The stock appears undervalued compared to industry multiples and may have upside potential, but with notable risks.